A look at Japan's crypto future

I'll begin by saying I'm not expert in the far east. I've spend a lot of time in South and South East Asia, but other countries, in particular Japan, are a complete mystery to me.

That said, I had a great conversation with my friends at Fracton Ventures, a Japanese accelerator, that prompted me to look into the Japanese market.

Japan was one of the first countries to embrace cryptocurrencies, and the biggest exchange in the world was based in Japan: the infamous Mt. Gox. Mt. Gox was also one of the first big crypto hacks and for a while it helped cement the idea that crypto is extremely risky and one can lose all their money. Tough reputation for crypto in a culture that is generally risk-averse!

Regulation as it stands right now is giving mixed signals for crypto users: on one hand, Japan accepts crypto as a legally accepted property and also a means of payment since 2017. On the other hand every cryptocurrency transaction is considered a taxable event - including purchasing goods and converting to yen. It taxes these transactions at a progressive rate that goes from 5% to... 55% with local taxes?! So all the burdensome record keeping necessary for every crypto transaction plus the high tax imposed on it might have made it impractical to obtain wide adoption.

And still with these hurdles, Japan rates 23rd in the world in the crypto adoption index according to Chainalysis.

Where to from here?

Japan is the 5th largest economy in the world, and every other economy in the top 5 has higher levels of adoption. Hence, there is a significant delta between current crypto activity in Japan and the one from its peers.

Will this delta be bridged? To me, it looks like the stage is set for an uptick in crypto adoption in Japan, but what would be the catalyst for it to actually happen?

Currently, a new change in the law is proposing to treat crypto gains like stocks, which could reduce taxes to 20% for long-term holdings. This is set to happen some time in 2026.

Interestingly enough, what might change the perception for this is the current change of direction of the regulatory environment in the US. Regulatory clarity -favourable, even!- in the US might push Japan to approve financial products like Bitcoin and Ethereum ETFs in Japan, which would then sort of give an institutional nod to the population that these assets are OK to invest on.

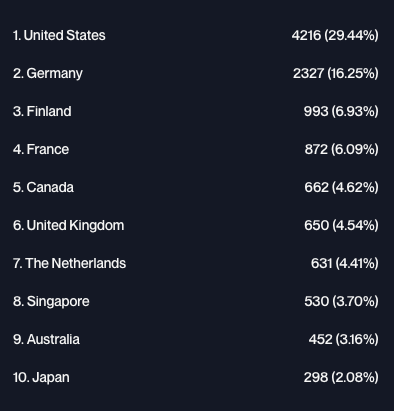

One more piece of data that I could piece together is that despite lower-than-expected retail adoption, the tech scene isn't all that bad in the Ethereum ecosystem. It's in the top 10 for Ethereum nodes!

All of this is good tailwinds for the crypto market in general - if Japan starts pouring money into crypto at a higher rate, as a rising tide lifts all boats. But it's also time to look into more regional players.

See you at ETHTokyo in September?